Slater & Gordon’s annus horribilis.

Long ago, there was a country club with a golf course called ‘Quindell’. A man called Rob Terry ran it, despite his previous company, Innovation Group, apparently vanishing up its own backside – leaving him some £12 million to build the country club. Nothing out of the ordinary, a reasonably successful businessman. Though reviews of club at the time said that: “greens really are awful, some of them fail to make the distinction between fairway and green” – later reviews of Mr Terry’s business acumen claim that his accounts fail to make the distinction between profit and loss….

The Innovation Group, floated with a value of £240m in the early 2000s and soared after notching up deals at the rate of one acquisition a month. It was alleged to have ‘overstated its own profits’, and lost ‘90% of its value’, amidst claims that the entire company was ‘smoke and mirrors’; it’s true share price not reflecting the fact that all the acquisitions had been made with ‘Innovative’ stock rather than cash. Mr Terry and another director, now also at Quindell, had managed to sell their shares and walkaway with a handsome payoff.

Between 2001 and 2008, Quindell’s accounts claim that Mr Terry had invested 11.5 million into building that country club. By 2008, Quindell’s accounts were claiming that Terry had ‘personally’ invested that same sum into building an ‘insurance/software/technology’ company. Nobody noticed the ‘three card trick’ at the time. Apparently no one remembered the reasons for the demise of ‘Innovative’ either.

It was picked up by the share analysis firm ‘Gotham City‘.

In 2010/2011 Quindell started reporting stratospheric profit margins. It seems Mr Terry was dabbling in mobile phones as well as golf balls. Quindell was offering shares in the company via the AIM market as a ‘highly profitable software consulting company’ by selling itself to an AIM listed company ‘Mission Capital’. (Pay attention at the back, its going to get a lot more complicated).

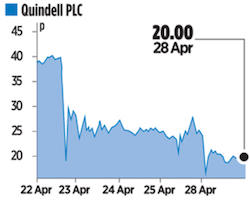

Once on the ‘junior’ stock market, Quindell started to aggressively buy up other companies. 30 or more. Quindell was positioning itself as a one-stop shop for claims management on behalf of motor insurers. In March 2014, it reported turnover of £380.1m, with a profit margin that would have been the envy of Microsoft. Venture capitalists and Fund managers fought each other to buy its stock. Then in April 2014, Gotham City published their hair raising report alleging that Quindell ‘was a country club built on quicksand’.

Once on the ‘junior’ stock market, Quindell started to aggressively buy up other companies. 30 or more. Quindell was positioning itself as a one-stop shop for claims management on behalf of motor insurers. In March 2014, it reported turnover of £380.1m, with a profit margin that would have been the envy of Microsoft. Venture capitalists and Fund managers fought each other to buy its stock. Then in April 2014, Gotham City published their hair raising report alleging that Quindell ‘was a country club built on quicksand’.

The report detailed how Quindell’s acquisitions had involved a complex web of loans and derivatives flowing between the two companies. It claimed that some companies had only been incorporated on the very day that Quindell ‘snapped them up’. Amongst other ‘peculiar’ practices, it had been revealed that Quindell was in the habit of giving Quindell shares to companies it wished to buy – who were then able to sell the Quindell shares at a later date to get their hands on the cash value of their company. Quindell shares had inevitably gone up in value after the ‘latest acquisition’.

In November of 2014, Mr Terry was forced to step down from the company, along with Quindell’s financial director, and another director, after it was revealed they had taken part in a controversial share sale and repurchase that had been, shall we say, severely under-reported…

By this time, Quindell’s business has become largely legal, heavily involved in settling claims – personal injury claims amongst others.

You might wonder who could possibly be interested in a company with such a sordid history, including the over valuing of ‘work-in-hand personal injury claims’, misrepresenting the value of acquisitions, less than candid dealings over share exchanges? All experience has a value, but unless you were interested in building a ‘ponzi’ company through acquisition and overvaluing work in hand – or had ambitions to run a golf club, it is hard to see the attraction of Quindell to a prospective purchaser.

Step forward the Australian legal firm of Slater & Gordon. They bought Quindell for £637m.

They also had an ‘interesting back story’. Bill Slater was a left wing politician, Hugh Gordon a barrister and Slater’s brother-in-law when they went into partnership in 1935. They operated out of a back room of the Australian Railway Union’s headquarters, from the outset focusing on the needs of unions and union members, particularly in the area of workers’ compensation.

By 1943 Hugh Gordon was dead, shot down in his Lancaster during WWII. Many of the later partners in the firm have had close connections to the Communist party.

By the 1980s Slater & Gordon’s over reliance on industrial accident cases was having a detrimental impact on the firm. In 1985, the Australian government reformed workers compensation laws, an act which was said to lose Slater & Gordon about 30% of its annual income. They fought back from near bankruptcy with an aggressive policy of borrowing several million dollars to fund rapid expansion with new offices. They bought out several of their competitors. Over the next decade, Slater & Gordon grew exponentially helped by the introduction of the innovative and revolutionary ‘No Win No Fee’ in 1994.

By 2007 Slater & Gordon had become the world’s first law firm to offer shares to the public – not without a fair few scandals along the way – notably Julia Gillard, first female Prime Minister of Australia, and a long time employee of Slater and Gordon, finding herself embroiled in a scandal when a ‘legal structure’ she had set up whilst at the firm for her boyfriend, Bruce Wilson, an AWU union official, turned out to have no official file in Slater & Gordon’s offices and led to a political scandal that dragged on for years. Eventually culminating in a royal commission into trade union corruption that was a great embarrassment to both Ms Gillard and Slater & Gordon:

Former prime minister Julia Gillard did not commit a crime and was not aware of any criminality committed by union officials during her time as a lawyer for the Australian Workers Union, the trade union royal commission has found.

But Ms Gillard demonstrated a “lapse in professional judgment” in her work for the AWU and at times gave “evasive”, “excessive” and “forced” evidence to the commission.

As though that wasn’t enough, one of the firms that Slater & Gordon bought, Keddie’s – taking on two of its solicitors as partners – blew up into a fantastical 70 claims-and-counter-claims law suit, that culminated in bankruptcy hearings and ‘suspension from practice’ that are a legal eco-system all of its own.

None of this made its way into the main stream media when Slater & Gordon entered the UK market, a bare 5 weeks after Jimmy Savile died, as the shinning knight of personal injury and negligence claims. The media was far more interested in regurgitating every last lurid allegation that could be levelled at Savile than looking at what was happening to the legal firms servicing those claimants.

The stock market gave Slater & Gordon the money to buy up Russell Jones and Walker, Fentons, Goodmans Law, Taylor Vinters, John Pickering and Partners, Pannone, Leo Abse & Cohen and Walker Smith Way; they had become the Pac-man of the ‘no win, no fee’ market, not only hoovering up claimants or ‘work-in-hand’ as they are known in the trade, but also all the alternative firms – many respected High Street names – that those claimants might have gone to. They represented the Police Federation – the Union for those investigating the varied allegations.

The stock market gave Slater & Gordon the money to buy up Russell Jones and Walker, Fentons, Goodmans Law, Taylor Vinters, John Pickering and Partners, Pannone, Leo Abse & Cohen and Walker Smith Way; they had become the Pac-man of the ‘no win, no fee’ market, not only hoovering up claimants or ‘work-in-hand’ as they are known in the trade, but also all the alternative firms – many respected High Street names – that those claimants might have gone to. They represented the Police Federation – the Union for those investigating the varied allegations.

Roll forward to April 2015 – and Slater and Gordon announced a mighty gulp – they were to ask the market for more money in order to buy Quindell for £637m to include fixed assets and ‘work-in-hand’ – some 60,000 ‘potentially successful’ claimants for work-related hearing loss formed part of the ‘work-in-hand’. The £637m price paid for Quindell was four times larger than the sum of all Slater & Gordon’s purchases since it went public in 2007. Allegedly, 70 Slater & Gordon lawyers had been involved in the due diligence on Quindell.

Nobody is owning up to finding it odd that they should be buying a company whose main worth appeared to be claims in hand that no one knew whether they would be successful or not.

Nor that this should be financed on the reputation of a company whose main claim to fame in Britain was hundreds of claims against the minuscule estate of one James Savile – and the BBC and NHS….

The main stream media remained consumed by tales of rings made of human eyeballs….

Three months later the autopsy commenced in quiet corners of the financial media.

Three months later the autopsy commenced in quiet corners of the financial media.

Slater & Gordon’s share price had collapsed. ‘On the books’, Slater’s had accumulated more than $200 million of profits since going public in 2007, but had spent $160 million of that buying up other law firms whose own profits then bolstered Slater’s ‘book value’.

Just as well – for many of the firms, owned by long retired partners and senior solicitors who had spent a lifetime building their company, were paid in ‘Slater & Gordon’ shares, which they had to retain for a time before selling.

Then young Nadya Nilova (yes, she is young – and brave!) entered the picture. A junior analyst at Bank of America, she stuck her neck out and wrote a report questioning whether, if the Emperor was not entirely naked, did he not require some wardrobe advice – for Quindell had just sold to Slater a bundle of 20 acquisitions, bought over the previous 3 years for £265 million – for £637 million! Tempers grew so heated that some big fund managers threatened to boycott Bank of America if they didn’t disown her.

Then young Nadya Nilova (yes, she is young – and brave!) entered the picture. A junior analyst at Bank of America, she stuck her neck out and wrote a report questioning whether, if the Emperor was not entirely naked, did he not require some wardrobe advice – for Quindell had just sold to Slater a bundle of 20 acquisitions, bought over the previous 3 years for £265 million – for £637 million! Tempers grew so heated that some big fund managers threatened to boycott Bank of America if they didn’t disown her.

June 2015 and Nadya was vindicated (and had a new job with a market trader who valued her courage at pointing out the obvious problems). The Australian Securities and Investment Commission had taken an interest in events at Slater & Gordon and begun investigating the firm and its auditors. The UK Serious Fraud Office has also announced an investigation into what went on at Quindell

Ken Fowlie, Slater’s UK head, explained that the problems at Quindell was: ‘that the Quindell PSD business ‘industrialised’ the personal injury claims process and was not made up of ‘rock star partners’. I can’t emphasise this enough Quindell is under new ownership and will play by our rules’

Presumably in future Slater’s would ensure that the ‘industrialised’ process would include ‘rock star’ defendants…

In the past few days, two major Australian law firms have announced that they are accepting registration for share holder class actions – Ironically, one of the firms, Maurice Blackburn is where young Bill Slater started his career as an articled clerk back in 1920. The other company is ACA Lawyers.

Slater & Gordon shares have now lost a stunning 90% in value.

In the past few days, Wayne Brown, the finance director and ‘company secretary’ has stepped down and been replaced by an Aussie Sheila, name of Moana Weir, who is also going to be in charge of legal counsel.

Bankers of the parent company in Oz have appointed ‘investigative auditors’ to scrutinise the books; in Britain the company have announced job losses and ‘asset realisation’ – otherwise known as selling Fenton’s valuable High Street premises.

It is a tragedy for individuals who are losing their jobs – they at least have some faint hope of employment elsewhere; for those partners and seniors who gave up their interest in their firm in exchange for Slater and Gordon shares – they may now be too old to replace what should have been their pension. For the individuals who put money in pension funds that only looked at the apparent meteoric share price rise via computer screens and not at what lay behind it, or rather didn’t lay behind it – it promises an impoverished old age.

It does, however, put into perspective Liz Dux’s ‘devastation’ at hearing that the ancient draft copy of the Dame Janet Smith report was inclined towards the opinion that the BBC had no knowledge of offences claimed by her school of ‘allegators’ to have been committed by Savile on BBC premises. A major ‘media’ success in that direction could be just what the embattled Slater & Gordon needed to weather this storm.

Slater & Gordon’s official position, pending all inquiries, is that they have been the victim of ‘short selling hedge funders’.

Talking of hedge funders – have we any news of Jerome Booth, the hedge funder who has been putting millions into the ghastly Exaro site? I have no reason to suspect that he is long or short on Slater & Gordon…

Never crossed my mind Guv. Even though this could turn out to be a financial scandal to dwarf the collapse of Robert Maxwell’s empire.

All in plain sight. Where the main stream media would never dream of looking.

- The Blocked Dwarf

January 31, 2016 at 3:06 pm -

I have no reason to suspect that he is long or short on Slater & Gordon…

I shall treasure that sentence, a classic of the ‘Really Should Mean Something Obscene In Cockney Rhyming Slang’ genre which will cheer me through the long, dark, cold Norfolk summer nights.

- Margaret Jervis

January 31, 2016 at 4:12 pm -

It would be interesting to see PR/advertising budget for S&G – not just wall to wall TV ads but the Ashes sponsorship too (alas, more ashes to ashes for the Oz owners).

And now another bombshell – reported that lenders have forced S&G UK to consult debt restructuring advisers – that’s the last hedge to insolvency.

Fact is seems the cupboard is bare re actual ‘profits’.

I don’t think the abuse cases headed by Liz Dux were ever going to be big money spinners – but they were a great loss-leader for publicity.

News story of allegations: Dux appears ‘ In the last few days I have been contacted by several other victims telling a similar story….’ Impression being S&G is the first stop agony aunt for anyone with a claim seeking to blame.With Leigh Day in the dog house and probably Phil Shiner’s Public Interest Lawyers too for the phoney Iraq claims and touting volume PI lawyers are being viewed with a dose of cynicism by the public and politicians alike – and it looks like S&G may be the biggest casualties.

Claimants may be justifiably miffed, but shareholders will be incandescent. They include major financial players and any legal contest would would leave S&G with its multitude of minnow claimants constituting its ‘work in progress’ (ie the hoped for profits) in shreds.

Still their resistible rise and outsize appetite lends new meaning to their business tag : ‘Consumer law’

- Pericles Xanthippou

January 31, 2016 at 4:28 pm -

I assume the ‘Qu’ pronounced as in French or Spanish; the ‘d’ silent.

ΠΞ

- Den

January 31, 2016 at 6:08 pm -

LOL

- Den

- Don Cox

January 31, 2016 at 4:32 pm -

Madam, you are a genius.

- Mr Ecks

January 31, 2016 at 5:01 pm -

Does anybody know when this BBC report is ever going to emerge?

- Jim McLean

January 31, 2016 at 5:48 pm -

Fascinating. I don’t think I was able to follow everything and will need to read this two or three times. But what I couldn’t understand at first reading was more than compensated for by Anna Raccoon’s writing style. She could make reading the phone book entertaining.

- Dr Cromarty

January 31, 2016 at 7:51 pm -

Interesting. The Met being very coy about naming the man they are questioning than they were in the case of Lord Brammall, Cliff Richard, Leon Brittan etc etc

- Bill Sticker

January 31, 2016 at 8:16 pm -

Slater & Gordon, Slater Walker? No relation to Slater Nazi I presume, although the M.O. of asset stripping does seem to be awfully familiar.

- Robert Edwards

January 31, 2016 at 8:17 pm -

Another brilliant forensic dissection. I’ve often thought the whole thing a bit dodgy, but had no idea that it was that dodgy. Will this mark the end of the compensation culture? I wonder if other, similar firms employ a similar business model?

- Mudplugger

January 31, 2016 at 8:44 pm -

Agreed. If this does contribute to the end of the pernicious, ambulance-chasing, creative compensation culture, then the pension losses of those who willingly sold up to the Aussie Devil is a small price to pay.

- Don Cox

February 1, 2016 at 11:59 am -

The Vaccination-Autism scam of a few years ago was much the same. Encourage “victims” to make claims from big companies, and pocket the fees.

In that case, they found a crooked doctor to bolster the claims.

I can’t remember the name of the law company.

- Mudplugger

- You must be Joe King

January 31, 2016 at 8:38 pm -

Attagirl – forensically accurate, and well-written. Bravo.

- Cameron mcarthur

February 1, 2016 at 1:18 am -

Wow

- GG

February 1, 2016 at 6:18 am -

This is a substatial scoop and a very good report. Congratulations!

- Jamie Millard

February 1, 2016 at 7:26 am -

Excellent and well written as per the norm by Anna Racoon. I have been following Slater & Gordon’s Collapse with a smile. 12 Operation Yewtree cases failed to bring any convictions and hence zero compensation.

Two of the 4 Jailed & 1 dead David Smith now involves what I know to be 2 Long but I know will be successful appeals against Sentence. So you’re all guessing “do you know who it is yet”?

Dux, exaronews, and the Daily Mirror who seem to be the Sponsors of the defunct Operation Yewtree & of course the Leading Calamity Commander Pc MW-T who has not had an exposure programme on mainstream Tv Since November 2012 ( I got the ITV Deputy news Editor Darryll Joe Murphy to get him pulled off ITV for being a fraud and the evidence produced meant he could not sit on the GMTV Sofa anymore calling himself a criminologist or ex Police Detective!! So you know see him chasing migrants heading for Greece back to turkey in his hired mini Yacht)! Or going to Dunkirk to annoy a camp of migrants who did not want him their!Ok so I don’t like the bloke as you may have gathered?!

Julia Gilliard was at one stage a Partner in Shameless & Gormless, oh I meant S&G! It was a fight over $67k used to pay off a house that did exist but the client didn’t? Who knows? So Julia got implicated when in power? Witch hunt? Their were rumours.

Yes S&G are in the deepest of the deep Mire with Fraud Claims that the over priced Quindells came with multi-Million Dollar back handers to those directors backing the takeover of complete & yes they too are being investigated by the SFO too. Plus a few companies in Aussie land suing S&G! But I won’t write a book as Anna is the Author and she’s 10 times better at this than I am.

On November 26th 2015 S&G lost half of its share price after ( George Osborne – please don’t boo him on this occasion ) made an announcement that this no win no fee whip lash malarkey is going to be no more and only cases requiring the expensive bigger courts would be the place for the claims. Most of S&G was under £5k!

The Good News is the Shares when I last looked were 60c yes about 30p each from a high of $8.08 but it gets worse as S&G promised vehemently that it would tell the world of its gross Cash Flow assets two weeks ago but…..doom doom doom are going to ignore that and tell us how little they really have at their 6 month financial report due out by popular demand in paper back and not available to buy in the shops or from K-tell on audio due on the 29th of February if they last that long!!

Have a good month all & watch Liz Dux’s desparate Twitter Timeline! To look at all her comments from everyone and me included just type Lizduxlawyer in to the Twitter application search box and leave the @ out and you can see all the eggs and bad apple comments aimed at her!!

Have a nice day.

Jamie Millard

- Misa

February 1, 2016 at 9:04 am -

The fat little ducks are sinking.

Plop!

- Fat Steve

February 1, 2016 at 9:18 am -

Ho! Ho! Ho! Ones heart bleeds …..and one wishes one might say what goes around comes around but on slightly deeper analysis sadly that is ulikely to be the case.

The loosers in this little game of pass the parcel are the mugs who invested in Slater and Gordon PLC ( or whatever designation the Aussie’s give to a Company listed on their Stock Exchange) . Some might say they deserve it though I am not so sure I would agree. I doubt there are too many widows and orphans with their inheritances tied up in the equity of S&G ……but it will be Joe Public through Pension and Insurance Funds that will have lost out.

It should be a salutary lesson about investing in a Solicitors Firm though if investing in Banks is anything to go by it it probably won’t be. I venture this opinion because lawyering is if anything more of a true ‘profession’ than banking and the distinction between a ‘profession’ and a ‘business’ is I suggest within the nature of what is ‘sold’ . One can try to commodetise the provision of legal services but I am not so sure that such an idea works terribly well in practice since there are inherent conflicts between the notions of profit and the notion of the administration of Justice. In theory there probably shouldn’t be but anyone who has been in practice realises there are.

It looks to me as if this is the old work in progress scam practiced on many a hopeful journeyman solicitor aspiring to be a Partner in the past when only a Solicitor could acquire equity in a Solicitors practice. After a few years toiling at the coalface in a firm and worrying more about earning sufficient profit costs to keep his job , the aspirant partner is solemly summoned to meet the Senior Partner (in my experience always with his side kick to weight the meeting) and given the eyewash of ‘how good’ etc the aspirant is. …..and as if doing the aspirant the greatest of favours ‘offers a partnership’ . Accounts are produced …..debts and work in progress taken off computer sheets and valued as if they were not numbers on a sheet of paper but actual money in the bank and the value of future business can be based on the recent past ( who but the desperate try to sell a share of the equity other than when things are looking at their best ….no different from selling shares in a company when it has reached its fullest valuation on a p/e ratio and fullest hope value . Takes balls to say no of course especially after one has invested a few years of ones life in working to obtain such an ‘offer’ . Big incentive also to progress from being a journeyman solicitor to being a Partner’ . I won’t bore Raccoonistas with personal experience ….Gildas will always speak with greater candour and eloquence than myself on such matters.

Of course work in progress/ book of debts is not the only thing to worry about. Reverse premiums are another ( look at the Halliwell partnership still mired in litigation so I understand) as is the ‘sleeper’ cock up case (Lord Goodman of Goodman Derrick apparently had sticky fingers when it came administration of Lord Portman’s assets) carefully anaethetised till it suddenly wakes often whilst the aspirant’s signature is still drying on the partnership deed.

Actually these scams if scams they be are rather too well known within the profession as indeed is the over supply of Solicitors which has resulted in too little work to go around and of course the rediculously high overheads of practice and some of the new generation are wising up and flogging equity in a Solicitor’s practice and getting a ‘proper’ price is becoming more difficult.

Step in the PLC (suitably professionally regulated just like the banks) and Partners now have punters other than the journeyman solicitor to flog their equity to.

When the Partners of Goldman Sachs sold out their interests to the public the more old school partners observed ‘ You don’t wash and polish a hired car’ .and I think one might go further and say some thrash the guts out of a hired car when they drive it ……perfectly lawful to so do of course unless they drive criminally ….and there is always insurance if there is a crash and a third party is injured ……professional indemnity insurance and the Solicitor’s compensation fund perform much the same function.

The joke here is Mr Terry seems to understand the game better than Solicitors do …..probably not my sort of charachter and I venture not the ideal sort of person to have a substantial interest in the administration of Justice …..but hell what’s that got to do with life in the 21st Century- Fat Steve

February 1, 2016 at 9:55 am -

PS You cannot imagine the respect I have for the skill and integrity of Nadya Nilova …..something of a surprise such people still get a look in in professions where profit has subsumed all other notions of what being sucessful means

- Jamie Millard

February 1, 2016 at 11:23 am -

I agree Fat Steve. Nadya is a one of very few people to put her morals and her job on the line to let the truth be known that all is not good at S&G. She would not have profited either way personally and took it upon herself to warn potential investors and those hoping to make quick profit based on just “we will win eg. £400m of cases & not loose one, just to give out a completely false profit projection based on winning every case.

Last thing I’ll say about the Savile witch hunt is that out of the 500 who made allegations after Saviles badly done & fraudulent exposure written and told by MW-T/Meirion Jones and anonymous voice over actors/ “Victims” they all went via the media/compo root first and then got round to calling yewtree via the nspcc who fielded most of the Yewtree enquiries!

Why oh why did non of these 500 alleged ‘victims’ not go for counselling years ago at the time they All claim they got abused, or at least see a doctor or go to the police? I do not believe when officially in 2002/2003 & 2008 3 official complaints were made to 3 different police forces about Savile. One was accompanied by a journalist at Surrey and the other two was in Sussex and South Yorkshire. All 3 cases were investigated and deemed not good enough to run with a prosecution.

So what on earth happened to the 500 other ‘Alleged Victims’ who never rang the police at the time of assault or before 2002? Not one complaint before that date!

Here’s a fact in that 15% of ‘Victims’ of abuse by any person/s will contact the police with in 48 hours and make a statement etc and get counselling & lots of help.

So if Savile had 500 victims then the maths of 15% will report abuse means that at least 75 of Saviles ‘victims’ would have phoned the police and make a statement etc!

So only 3 recorded complaints that were all investigated and not one other complaint before 2002, that includes Saviles niece who decided to cash in ASAP.How does compo work. It’s well known that the media like the Sun & ex-NOTW & the daily mirror etc have extensive journalistic databases on every celebrity or VIP of interest all filed in to which school they went to, to the decor of their offices and houses they’ve lived in. I’ve seen the NOTW’s database and it’s a encyclopaedia of anyone famous.

‘Victims’ & Jim Davidson said something similar is that a newspaper or compo company will source a huge amount of professional ‘victims’ and take them through a story which will match times and dates and interiors of a VIP or celebs house and base an abuse story around that.

It’s a disgusting practice & Liz Dux et al have led the way. Remembering this is just Savile & not even calculating all the others from the celeb & VIP witch hunt.

So no the sums don’t add up & the newspapers are starting to make their money now out of the new ‘in word’ witch hunt as celebs and VIPs are now taking action and the pendulum has now swung in the Witchunt direction in many newspapers with the daily mail & telegraph doing a good job of trying to repair the damage all the media had done in the first place.

Ok I’ll leave it their & have a nice day all.

Jamie

- GG

February 1, 2016 at 6:00 pm -

>>I’ve seen the NOTW’s database

That’s very interesting Jamie. Where? And do you think it still exists (as the newspaper doesn’t)?

- Jamie Millard

February 5, 2016 at 3:42 pm -

2011! It was online. Don’t be a smart arse! The NOTW is now the Sun On Sunday as you know. I’ve seen the database which is not a state secret and mentioned by many others.

- GG

February 5, 2016 at 5:33 pm -

Thank you. By “it was online” do you mean an online database owned by NewsInt and accessible by anyone working on the NOTW or was it a more general database (like Lexis or whatever)? And when you say you saw this, where did you see it, in the newsroom or where?

- Jamie Millard

February 5, 2016 at 10:14 pm -

I think if you did your homework you’d find out that the ex-news of the world had a great big room full off Indexed stories & facts plus data on just about any person who could sell as a good story. Go google it as its out their. It also got processed online and I expect the Sun on Sunday & the Sun are still using it to this day. As to how did I see it. I’ll leave that to your imagination as it still makes up part of a criminal case I was involved in for a miscarriage of justice case. Anyhow every newspaper has large databases of the same but to a lesser degree. Anyhow this topic is about S&G and could you tell me why you seem concerned about this database in computer & paper format?

- Jamie Millard

- GG

- Jamie Millard

- GG

- Jamie Millard

- Don Cox

February 1, 2016 at 12:06 pm -

” it will be Joe Public through Pension and Insurance Funds that will have lost out.”

And in this case, the wounded soldiers who would have benefited from Saville’s will.- Fat Steve

February 1, 2016 at 12:37 pm -

@Jamie Millard

She would not have profited either way personally.

Not necessarily so Jamie

Tempers grew so heated that some big fund managers threatened to boycott Bank of America if they didn’t disown her.

Presumably some B of A Clients held the parcel at that point in time and needed the music to play for a while longer. Had she kept schtum then she wouldn’t have risked loosing her job …..mind you her Boss must have been a decent stick …..he could have quietly filed the research .

- Fat Steve

- Fat Steve

- ivan

February 1, 2016 at 10:57 am -

I think we shouldn’t say it but ‘it couldn’t happen to a better bunch’. An excellent post Anna.

- Andrew Duffin

February 1, 2016 at 12:41 pm -

Two lessons to learn from this astonishing snake-pit of corruption:

1. Have nothing whatever, directly or indirectly, in any way at all, with no-win no-fee ambulance-chasers.

2. If something looks too good to be true, it probably is.

Unfortunately there seems to be a never-ending supply of suckers waiting to be parted from their money.

- English Pensioner

February 1, 2016 at 1:50 pm -

I must admit my admiration of anyone who has the patience to plough their way through all the various documentation and come up with a post like this. If only some of our official report writers could emulate your style, their reports would make far more interesting reading!

- Fat Steve

February 1, 2016 at 1:51 pm -

Being of a literary bent, just as I see room for a modern version of Heart of Darkness crafted around a post colonial politician instead of the archetypal colonialist Kurz . the modern shiny face of London now playing the part of Brussels and the various minions fussing around him and laundering his money like staff at Central station so I think an enterprising wordsmith might craft a modern day version of the Voysey inheritance which reflected the moral underbelly of Edwardian England…..”in The Voysey Inheritance, the dishonesty implicates not only the individual Voyseys but the institutions, ideology, and economic base of Edwardian England”. The Voysey inheritance was about straight theft and I am not suggesting anything of the sort about any of the players in Anna’s article just a potential similarities in looking the other way when its convenient to so do. A Solicitor’s firm with concommitant notions of respectability and integity made the perfect setting for the original Voysey inheritance and the same might work equally well now.

- Major Bonkers

February 1, 2016 at 9:08 pm -

Or Ben Jonson’s ‘The Devil is an Ass’, in which the devil visits the City of London and is comprehensively cheated and defrauded by the good gentlemen there, before skulking back to Hell.

- Major Bonkers

- Bandini

February 1, 2016 at 2:15 pm -

An excellent article, Anna, but just the slightest word of caution regarding Quindell / Gotham City – Quindell sued for libel & won:

As described the ‘victory’ had no real effect as the shady Gotham City had no assets in the UK that could be pursued, and maybe Quindell are too far gone now anyway, but…

- Duncan Disorderly

February 3, 2016 at 10:00 am -

Quindell won by default, as Gotham were based in the USA and so didn’t bother turning up to court. It doesn’t reflect well on them, but it’s different from a situation where a judge clearly analysed both cases and decided in favour of Quindell.

- Bandini

February 3, 2016 at 1:10 pm -

I was thinking of the danger of a cut snake (to anyone with UK assets), rather than in any way trying to defend Quindell.

Regarding Gotham, no one seems to know exactly who is behind it, which makes a headline like the following seem incredible:“The day Gotham City’s tweet cost Quindell £1bn”

“On its sparse website, the short-seller describes itself as focusing on “due diligence-based, special situation investing” and no contact details are given. A man called Daniel Yu has previously identified himself as a director of research at Gotham. Little is known about Yu, other than that he is thought to be present on Twitter, the social networking site, under the pseudonym LongShortTrader.”

That Twitter-handle may be telling, as in my experience the same shadowy groupings of people (or their friends/family/associates) often make their money on the way up as easily as on the way down. It’s to say, they are as happy to sell you magic beans (when they are long) as they are to tell you later that those blasted beans don’t do a damned thing (when they’ve gone short).

Almost impossible to prove, of course.

(I noted that the Gotham research made the comparison between the London AIM market & the American “OTC / Pink Sheets”, which is probably closer to the truth than anyone having to rely on the AIM-regulators would like to acknowledge! From Wikipedia: “OTC Pink is an open marketplace that has no financial standards or reporting requirements.” Giddy-up, it’s the Wild West…)- Jamie Millard

February 7, 2016 at 6:05 pm -

Daniel Yu is a young and very bright part time but excellent Statictician who also quoted S&G of double accounting the cash assets in 2014 where the variance was so far off that he wrote to S&G and they admitted to their mistake and altered the figures accordingly. He has a habit all be it of good intentions of decimating and spotting false accounting & the City and those opposed to him make a habit of calling him young Dan (meaning he’s got not as much experience than someone who’s done the same job for years to try to degrade his financial findings) there are plenty of his graphs on Gotham City’s web site. Worth a look.

- Jamie Millard

- Bandini

- Duncan Disorderly

- Dave

February 1, 2016 at 8:45 pm -

Another newcomer to the legal marketplace bites the dust.

Every single one has thought that providing legal services was a licence to print moneyAnd another one imminent

http://www.lawgazette.co.uk/practice/listed-law-firm-pioneer-halves-profit-forecast/5053345.articleGood comment to- “It’s just idiocy to think that anyone can turn a personal service business into something that can be floated on the stock exchange.

I have always been a sole practitioner and have had staff lawyers. The problem is that everyone looks at their own situation and tries to bill enough to cover their own costs to the firm. All fee earners are reluctant to work harder to line the pockets of the proprietors unless there is an incentive, such as partnership. What is the incentive to work harder to pay shareholders who don’t contribute any fees? The whole concept is silly because anyone who wanted to progress in the profession would go and work somewhere where they had an opportunity to share in the profits. What this move towards outside funding represents is an attempt by partners of law firms to off-load their debt burden on unsuspecting investors who are awed by the concept of getting control of a law firm, thinking that lawyers are all rich, money generators. The truth of the matter is that many law firms around the world are struggling. You only see this, in many cases, when the firms close down or go bust. I’ve seen many law firms resort to fraud on junior partners, false accounting to show inflated profitability and padding of bills to clients. I’ve seen large law firms go bankrupt and elderly lawyers ending up with huge mortgages against their homes because they have carried debt of their practice throughout their careers.” - Robert Edwards

February 1, 2016 at 9:08 pm -

The ‘victim of short sellers’ plea is an old and disreputable one. After all; the next thing which short sellers do is to buy back and there’s nary a sign of that. Why not? If the shares are trading at the square root of fuck all then one might as well have them back. Because a phantom ‘bail out’ is always a possibility, depending upon how well connected the ‘victim’ is.

But if this marks the end of the ambulance chasers (which I rather doubt) then I am sure it will usher in a new hybrid of some sort as the ground available for harvest is both softened and fertile. Indeed, I’m q. surprised that some creature has not already emerged from under a rock regarding a certain late (and lamented) broadcaster, firing accusations all over the place.

- Bandini

February 1, 2016 at 9:56 pm -

The media are too busy with – chuckles to self – ‘camp’ actor John Inman at the moment. What took them so long, and when will we find out the truth about Mrs. Slocombe’s pussy?!?

“The alleged victim said Mr Inman used an accomplice [in 1979], who was wearing a pink robe…”

According to Inman’s niece: “You look at all the Jimmy Savile stuff and who is jumping on the bandwagon – people seeing an opportunity.”The police have launched an investigation…

- Peter Raite

February 2, 2016 at 11:20 am -

So a 48-year-old claims that at the age of 13 he was assaulted by Inman in 1979. Er… didn’t anyone do the basic maths on that one?!

- Eric Hardcastle

February 7, 2016 at 3:20 am -

I think this is just another tawdry Sun tale & some nutcase has walked through he door at a convenient time when a space needs filling. . The story claims police are investigating but even with the Savile madness why on earth would they?

- Eric Hardcastle

- Peter Raite

- Bandini

- Oi you

February 2, 2016 at 6:53 pm -

Excellent post. Keep it up old gal!

:o)

- Duncan Disorderly

February 3, 2016 at 10:44 am -

The FT Alphaville blog have been looking at Quindell since the Gotham report. Registration required, but worth it. It is inexplicable why S&G bought it, since it was a clear pile of shit:

http://ftalphaville.ft.com/tag/what-is-quindell/ - john gibson

February 4, 2016 at 1:25 am -

The pickering post wrote a series of blogs about Julia Gillard.

http://pickeringpost.com/story/is-the-prime-minister-a-crook-part-ii/335- Eric Hardcastle

February 7, 2016 at 3:16 am -

I wouldn’t take Pickering too seriously. He also ran a Internet Gambling Scam guaranteed to win at the races every time although needless to say, 1000s of investors lost their dosh. His son is also on some serious charges relating to their activities together. He lives on Queensland’s Gold Coast where just about every Aussie con-man and grifter reside. ( the prowess of Aussie con merchants is legendary worldwide only eclipsed by their Tasman cousins in New Zealand who are said to be even better)

Pickering seems obsessed with Gillard and has drawn some quite nasty pornographic cartoons about her. He’s basically a Nazi.

- Eric Hardcastle

- Rocky Racoon

February 4, 2016 at 11:14 am -

Considering the hundreds of people who claimed to have that £33m lottery ticket what are the chances of a similar number of chancers staking a claim in £4m where no proof is required?

- Jamie Millard

February 5, 2016 at 10:19 pm -

Oh bugger! No more lottery for me! You are right Rocky Racoon. Now all I need is a story that won’t get investigated plus a compo deal & a visit to C9’s 60mins & a paper deal.

Cheers Rocky.

- Jamie Millard

{ 52 comments… read them below or add one }