Freebies on offer, roll up, roll up!

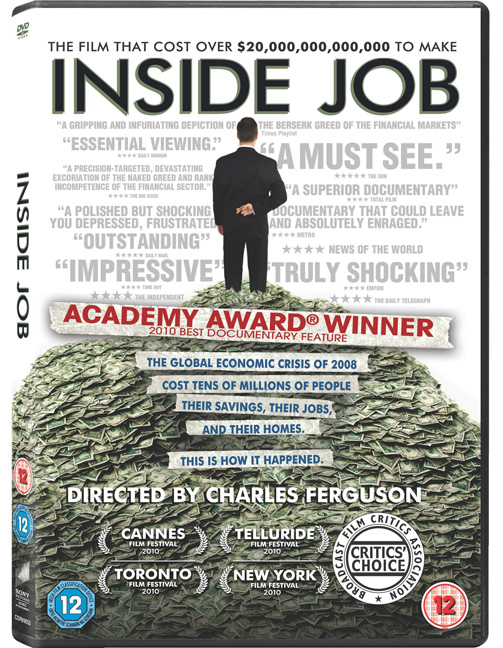

I’ve been doing well this week – first Stuart Fairney’s book arrived in the post, then an advance copy of a riveting DVD. ‘Inside Job’.

It genuinely is a riveting DVD; it’s well made, fast moving, informative, a thoroughly professional film as you would expect from an Oscar winning film maker – Charles Ferguson.

120 minutes, ‘as gripping as any thriller’ (did I just quote the Guardian!!!) it aims to impress as a ‘warts and all’ look at the disastrous financial tsunami which has swept over the world.

My gripe is that some of the warts only made an appearance when they could be shown in a favourable light, the opposing view, which a balanced documentary should have, sought recourse to a few foreign warts to pad out the scenes.

As a keen political observer, I found that I was screaming at the screen as often as I do at the news on the BBC.

The film is heavy on the ‘bash the bankers’ front. There is a longish section on the rewards available to bankers – the yachts, the private planes, the estates on the Hampton’s, are given the benefit of lingering salivating footage. The prostitution, the cocaine consumption is dealt with thoroughly; interviews, depositions, and the essential shot of supra-naturally high heels and comely ankles pounding a night time street.

The film starts with one of the ‘foreign warts’ – a ten minute section on how Iceland deregulated its banking system and the disasters that followed. Beyond that, deregulation barely gets a mention beyond being something that Ronald Reagan ‘started’- those damn Republicans – and Obama, now post apocalypse, is definitely in favour of!

It fails signally to mention that Obama, and Clinton, was only too happy to lobby for the relaxation of the Glass-Seagal Act which gave his voter base the opportunity to buy an all American home (one of my earliest posts!) for a mere handful of dollars down and no questions asked.

Once upon a time, banks were started by wealthy industrialists. They used their own money. Naturally they were rather keen to see that not only did they get their money back, but they made a profit on it. They took a long hard look at the people who wanted to borrow money and if they didn’t like what they saw, they didn’t lend them anything.

The banking industry had been seeking the repeal of the 1933 Glass–Steagall Act since the 1980s, if not earlier. Of course they were. Drug dealers have been seeking the repeal of Narcotics laws. Fishermen want the repeal of fishing quotas. It was Clinton who bowed to their demands with the Financial Services Modernization Act of 1999.

Neither bankers nor regulators ‘make’ the law, politicians do that. Whilst the film spent a long time exploring the ‘back story’ of the Regulators – surprise, surprise, they all turned out to have previously held high positions in the banking industry; what did they expect? Professional Fishermen? Deep Sea Divers? There was very little, seconds if that, of the role that Politicians played in all this.

No exploration of why they wanted deregulation – what was in it for them – Obama, Gordon Brown?

As far as this film was concerned, there was only one guilty party – the bankers, ably abetted by the regulators who were ex-bankers. As though they operated in a void.

If you get a job as a double glazing salesman, and you earn 10% of every sale you make – do you stop when you have reached what you think is a ‘moral level’ of remuneration? Do you reflect on the problems you may be storing up in the developing world when all those plastic windows end up in land fill? Do you Hell! You sell as much as you have the energy to do so, and enjoy your good fortune while it lasts.

Quite why it is so popular amongst a particular political persuasion to blame the salesmen and not the politicians who changed the law to permit the product to go on sale is beyond me. Bankers are salesmen; they will sell whatever they are allowed to sell.

None of which should take away from the fact that this is an excellent film, that will explain the complex financial instruments used in a most enjoyable and accessible way.

It went on sale yesterday at http://www.sonypictures.co.uk/ for £19.99. ‘Inside Job’.

No, I haven’t been paid for writing this, but since they were kind enough to send me a free copy, it seemed only polite to let them know what I thought of it.

So – who would like to watch it next? I have a copy sitting on my desk…..

Last commentator gets it….Dutch auction!

June 15, 2011 at 10:57

June 15, 2011 at 10:57

-

Anna, your comment is slipping!

June 15, 2011 at 10:56

June 15, 2011 at 10:56

-

It is simply the elite getting on with their enrichment while promoting a

centralised consensus of control. Something along the lines of an elegant and

elitist, modernised Frankfurt School.

http://en.wikipedia.org/wiki/Frankfurt_School

This film,

of course, being part of the obfuscation/inversion. As is everything that gets

published in the consensus-controlled media.

June 15, 2011 at 05:04

June 15, 2011 at 05:04

-

They came on to get all the freebies

It was better than watching

C-Beebies

Now it’s me on the thread

Which ‘oft kills it dead

I’ll win

if I cause heeby-jeebies

June 14, 2011 at 22:39

June 14, 2011 at 22:39

-

I’ve worked in banking for a couple of years now. I’ve yet to see any

cocaine or prostitutes, but we did go out for a pub lunch once.

June 14, 2011 at 20:42

June 14, 2011 at 20:42

-

Bankers and regulators are pretty much the same guys wearing different

hats.

Waving big sticks at themselves for being such greedy bankers while

their state/regulator personas nationalise large chunks of the

economy.

Tweedledum and Tweedledee.

I think if one looks at was has been

achieved (more state intervention, effective nationalisation of banks,

financial institutions, car manufacturers, impoverishment of middle and lower

middle class, devaluation of currency by printing zillions, enrichment of said

printers, etc, etc) one can get a fairly good idea of what it was all

about.

June 14,

June 14,

2011 at 20:31

-

There’s a really simple answer going forward.

Banks shouldn’t be allowed to sell on or in any way insure their lending.

So if someone defaults, the bank picks up the tab – that’d make the greedy

bastards a bit more careful …. especially if bonuses were reduced when losses

were incurred.

June 14, 2011 at 17:37

June 14, 2011 at 17:37

-

“Diamond Mortgages came round the door today” said my friend, on incapacity

benefit, living in a council house – I guess that was about four years ago,

maybe longer. “Don’t even think of it” I said. My friend is genuinely ill with

heart problems, diabetes, and a multitude of other ills. But like so many he

wanted to better himself, own a home rather than rent from the council.

I talked him out of it – although he protested that they had told him being

on benefits ws no problem and that they could deduct the payments from his

benefits.

Well, he didn’t go ahead – others on that council estate did (although I

have no idea whether it was with the same company.) All I know is that those

who bought their council homes on that estate have all been re-possessed –

evicted through being unable to keep up the payments, pushed even further into

debt than they probably already were. So much for helping the poor !

June 14,

June 14,

2011 at 16:46

-

In many cases a mortgage is no dearer than paying rent, so people will go

for that option. It’s worth a gamble because if it all crumbles to dust after

a few years they can walk away leaving the bank with the repossessed house,

they ‘lost’ their money but would have been paying it in rent anyhow.

(This

could be a very long thread)

June 14, 2011 at 16:05

June 14, 2011 at 16:05

-

Before we start to slag off the people who borrowed the money let’s

consider a few points.

The average person could be forgiven for putting their trust in bank

employees, after all thay are supposed to be the experts. If they say you can

have it, then why question it.

After years off not being able to get on the

housing ladder, here was a golden opportunity. Not everyone is a financial

expert, therefore you rely on people who are supposedly better placed to

advise you. In fact this works in most walks of life, whether it be, Doctors,

Lawyers, Mechanics etc.

June 14, 2011 at 15:52

June 14, 2011 at 15:52

-

+1

June 14, 2011 at 14:46

June 14, 2011 at 14:46

-

Last commentator gets it?

This could run and run!

June 14, 2011 at 13:02

-

I also thought it was a good film, though again a bit incomplete. For

example, there is no mention of the thousands of people who actually took out

the mortgages that they were never, realistically, going to be able to repay.

Certainly, the banks shouldn’t have been lending them in the first place and

the assorted Governments shouldn’t have let the banks bundle them all up and

sell them on as if they were sound investments, but at the same time, you’ve

got to be a bit of a berk to borrow 6 or 7 times your income to fund 100% or

more of the purchase price of your house and think that everything is going to

be just groovy.

That being said, those people were just a bit dumb. The bankers were evil,

corrupt, greedy bastards, and I think that’s an important distinction. As far

a politicians letting them do it, I remember it being mentioned in the film a

bit more than you refer to it, but it was awful selective, and it didn’t

mention that governments all over the world were deregulating and not just the

US were doing it.

June 14, 2011 at 13:40

June 14, 2011 at 13:40

June 14, 2011 at 13:47

June 14, 2011 at 13:47

-

“…you’ve got to be a bit of a berk to borrow 6 or 7 times your income to

fund 100% or more of the purchase price of your house…”

What would be a

better choice to make?

Most of us have to do our best in the financial

climate we are in, and if irresponsible lending and borrowing have pushed up

prices to the point where you can only buy by borrowing irresponsibly, you

have little coice but to go along with it.

June 14, 2011 at 13:00

June 14, 2011 at 13:00

-

Presumably the DVD won’t go to this bunny but will make sure I watch it all

the same.

Nice little job that politicians did blaming the ‘financial crisis’ and

appealing to the politics of envy and a wish to blame bankers for all that

went wrong. Can’t blame them for doing what politicians do, but the

‘deregulation caused the crash’ line is more misplaced conventional

wisdom.

The reason the financial sector became utterly reckless is beacause

governments in the US and UK in particular egged them on and therefore tied

themselves into clearing up any resulting mess. If the banks had been told

that they were on their own in the event of a meltdown would they have started

to lend more responsibly? And would we be where we are now?

http://outspokenrabbit.blogspot.com/

{ 21 comments }