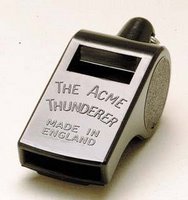

Whistle a happy tune……

It has been a spectacular few weeks for that endangered species, the Whistleblower.

It has been a spectacular few weeks for that endangered species, the Whistleblower.

First up was Paul Moore, who had patiently bided his time and delivered a broadside under parliamentary privilege to the Commons Treasury Committee, securing not only the scalp of his former boss, Sir James Crosby, but delivering a nasty wound to the backside of the Prime Minister.

Then neighbours of ‘Second Home Secrecy’, Jacquie Smith, successfully twitched their curtains and blew the unwelcome wind of scrutiny by the toothless Parliamentary Standards Commissioner, John Lyon, up her skirt.

Yesterday, a Venezuelan financial analyst, Alex Dalmady, was revealed as the finger on the trigger which blasted Allen Stanford’s billion dollar Ponzi scheme out of the water.

In all three cases there were highly paid professionals staffing regulatory agencies, respectively, the FSA, The Standards Commissioner and the Securities and Exchange Commission, which exist solely to uncover these scams. They are not required to prosecute scams, that is for the Police and FBI – their function is merely to use their ‘superior’ knowledge and experience to notice when something is going wrong.

Yet all these scams would still have been firmly beneath the water line without the bravery and initiative of relative amateurs.

Hat tip to Cityunslicker who has added another twist to this tale; highlighting whistle blower Graham Milne of Lloyd’s TSB, and the ironic detail that Carol Sergeant who was awarded the CBE and made a Trustee of the charity Public Concern at Work (motto: Making Whistle-Blowing Work) had previously been the Managing Director of the FSA that had dismissed Milne’s allegations – and subsequently became the Chief Risk Director at Milne’s old employers…….Lloyd’s TSB.

March 17, 2009 at 10:31

-

And seen in the papers today (17.03.09):

“HM Revenue & Customs (is) investigating explosive allegations about

tax avoidance schemes operated by Barclays Bank, made by a whistleblower in

the firm and apparently substantiated by leaked documents. HMRC’s moves came

as the government announced steps to try to discourage tax avoidance by

Britain’s banks, now frequently dependent on state aid. The chancellor

launched plans for a code of practice in which banks would be expected to

abide by the “spirit of the law”. Darling said the government had taken action

against tax avoidance in every budget since 1997 but that, as soon as one

loophole was closed, another opened up. “Partly because the very complexity of

banking, the way in which, sometimes just investment banks and sometimes

others have sought to develop instruments in order to avoid pay taxes has in

itself posed a systemic threat to the system.” (from The Guardian website)

From the Daily Mail website:

“The chancellor signalled last night that

another rescue package is on the way – to be paid for by tax rises and

spending cuts. Alistair Darling made it clear that a further boost was needed

to jolt the UK out of recession, despite a growing black hole in the public

finances.

But a report warned yesterday that tax income from the financial

sector is set to almost halve. The Centre for Economics and Business Research

warned that revenue from the City will be

March 16, 2009 at 12:08

-

Another shrill whistle-blast brought to us by The Sunday Times (15.03.09)

:

“Barclays, the high street bank, is alleged to be making about

February 20, 2009 at 22:11

February 20, 2009 at 22:11

-

Room for one up top!

February 20, 2009 at 22:06

-

That’s like a Red Rag Trade to a bull market; still, there’s Room at the

Top

February 20, 2009 at 22:00

February 20, 2009 at 22:00

-

Miriam Karlin and factories, everybody out!

February 20, 2009 at 06:13

February 20, 2009 at 06:13

-

Whistleblowing is to be made a criminal offence in the NewStassi’s upcoming

593rd Criminal Justice Bill this week. The Home Office is at pains to state

that it is concerned about the number of people in our great country,

increasing in recent times, that are not acting in the state’s best interest.

Therefore, to make it very clear that the government will not tolerate such

behaviour new clauses have been added to the bill that will stop people having

an opinion other than that which is acceptable to government. As part of the

police’s OpenMouth policy, people will be regulated in a small number of

offices and factories to trial the new regime. It is hoped the scme will be

‘rolled out’ nationally by the end of next week.

February 19, 2009 at 22:14

-

No, I won’t bloomin’ whistle a ‘appy tune ‘cos I ain’t at all ‘appy. I’m

sick to me liverish gills with it all. I don’t think I’ll ever be able to

enjoy my kazoo again. (bang goes the national tissue-paper sales)

February 19, 2009 at 15:25

February 19, 2009 at 15:25

-

Does bravery and initiative mean the same as disgruntled and revenge

seeking?

{ 8 comments }